One of the evergreens on China's economy is, when will the country shift to a so called more balanced economic model. Other said when will the share of consumption on GDP increase to levels comparable with average in other emerging economies or even developed countries. The topic is on the table for over a decade, policies applied, but no desired results. Moreover it's exactly vice-versa, the portion which consumption represents on China's GDP did drop in the past 10 years.

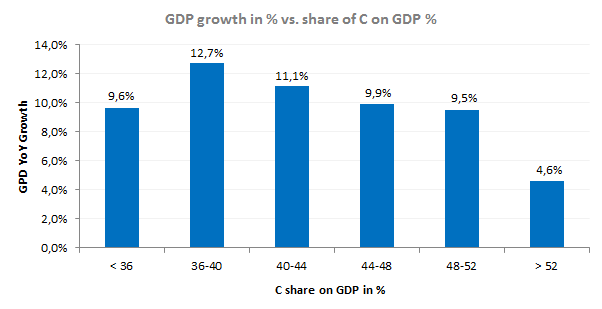

Today it's just somewhere around 35 %, far below, what's in Western, BRIC and even SE Asia countries. Beijing reacts, as their economy rises and falls with fixed investments and exports (respectively demand in developed countries) – but look at the graph below showing link between share of C on GDP and GDP growth.

When Deng Xiaoping launched the economic reforms almost 35 years ago, the master strategy was - we will open doors to the foreign investors, they will spend money here, build factories, give work to our cheap labor, export the goods out of China and our economy will grow. And indeed, an economic giant did grow up, made of NX and I, but the C was forgotten in the very back. At the end of 1970s Deng's growth strategy was fair enough, today it needs adjustments as the world economy is somewhere entirely else. A strive for a more private consumption based economy is desirable for China.

When Deng Xiaoping launched the economic reforms almost 35 years ago, the master strategy was - we will open doors to the foreign investors, they will spend money here, build factories, give work to our cheap labor, export the goods out of China and our economy will grow. And indeed, an economic giant did grow up, made of NX and I, but the C was forgotten in the very back. At the end of 1970s Deng's growth strategy was fair enough, today it needs adjustments as the world economy is somewhere entirely else. A strive for a more private consumption based economy is desirable for China.

Let's list us important variables typical for Chinese economy and consumers, important if we speak on consumption in China - high propensity to save, (probably) undervalued currency, wages level and non-existent middle class (the hundred or if it's two hundred millions of people is not a middle class in almost 1,4 billion nation).

The key to have a fair private consumption is to have a robust and stable middle class, which can spend money. Valid? Look at other BRIC countries - is there a robust middle class present? No. And still they have share of private consumption to GDP well above 55 %. And we have to be asking further - is China having a middle class? Certainly does, but it's still far from what it should be.

Another evergreen on Chinese economy is the (most probably) undervalued national currency (popular say on this is, that Beijing has stolen purchasing power from Chinese consumers and granted to the US ones). We don't have to dig deep to see, that on domestic goods pricing this has a rather limited and indirect impact. But it has a huge impact on imported goods. Not only thru the national currency exchange rates, but also thanks to duties levied on certain products and yet immature consumer market - pretty much everything imported to China is overpriced comparing to Europe and rather don't talk about the US.

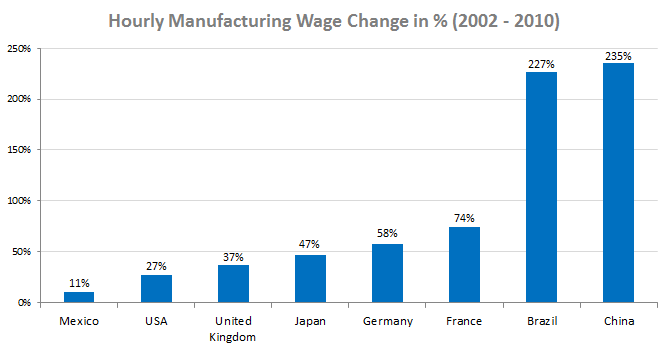

For a long period the key driver of Chinese competitiveness was wages, which we can understand as future consumption. This factor was undermined for decades in China. Influx of workers from central part of the country did work against pay rise, notably in the manufacturing and construction industry. On contrary in the past several years, the wages (notably on China's East Coast) did shoot up. Between 2002 and 2010 the average hourly wage did increase by 230 % (compare to USA with less than 30 % or Germany with below 60 %) measured in USD (there was some appreciation of CNY against USD, but doesn't change the figure a lot).  And now tie together such enormous rise in pay and drop in consumption share on GDP. The today's level of wages in certain industries is well over most SE Asia countries and in par with f.e. SE Europe countries - how long will China remain competitive? Yes, it's not just about wages, also about the production capabilities and infrastructure to move the production, which China has. A shift is a matter of time, right?

And now tie together such enormous rise in pay and drop in consumption share on GDP. The today's level of wages in certain industries is well over most SE Asia countries and in par with f.e. SE Europe countries - how long will China remain competitive? Yes, it's not just about wages, also about the production capabilities and infrastructure to move the production, which China has. A shift is a matter of time, right?

Not to drawn in credits, to save certain chunk of disposable income is implicit to chinese society. It's tied to rules historically valid in chinese families and also to non-existence of social safety net for close to whole population. If you combine that with the factors listed above you can't build economy with high portion of private consumption.

I have stated above that share of consumption on China's GDP is below 40 %. In SE Asian countries it's somewhat higher, but doesn't go over 55 %, Europe typically around 60 to 65 %, USA over 70 %. In the West a large chunk of money going to consumption comes from credits, in China it’s far below that. One could challenge me now with the enormous growth of consumer credits volume in China since 1999. True, but above 80 % of that were mortgages, thus not hitting the C bucket. The willingness and ability of young urban chinese generation to "live with credits" will to be one of the important variables in the fight for consumption fueled economy. There are studies forecasting quick move in the GDP structure, but just taking into consideration what we listed above and the changes in GDP composition in the past 20 years I expect a slow evolution towards higher consumption share on the economy. Surely it will not get near 50 % by 2020, just wish of corporations suffering by demand drop in the West. It will be interesting to watch the progress of Beijing and yet more interesting to see if China will reach higher share of consumption without loosing the competitiveness and role of the world's manufacturer.